Is the Decrease in Housing Mortgage Loan Approval Amount by 8% Indicating the Effect of Loan Regulations?

Last month, it was confirmed that the new housing mortgage loan approval amount from the five major banks decreased by over 8%.

According to a report by News1 on the 3rd, the total housing mortgage loan approval amount for July from the five major banks—Kookmin, Shinhan, Hana, Woori, and Nonghyup—was recorded at 10.7 trillion won.

This figure represents about an 8.3% decrease compared to June (11.67 trillion won). In terms of value, this amounts to a decrease of nearly 1 trillion won. It is interpreted that the government's 'June 27 Loan Regulation' is having an effect of calming the surge in loans focused on the metropolitan area.

The approved mortgage amount refers to the amount that consumers receive approval for after applying for a loan and passing the assessment by the bank. Typically, loan demand is assessed based on the outstanding balance, but since the balance includes new loans and maturity situations, the approved amount is considered a more significant indicator of actual market demand.

The Effect of Loan Regulations: Still at the 'Starting Stage'

However, there are views within the financial sector that this decline is just the beginning of the regulatory effect.

It typically takes about a month from application to approval for housing mortgage loans, meaning that a considerable number of applications approved in July were submitted before the loan regulations were implemented.

An official from a commercial bank stated to News1, "With the implementation of the stress DSR (debt-to-service ratio) Stage 3 starting in July, forecasts of reduced loan limits led to a rush of demand to secure loans in June. Particularly, due to the sudden announcement of the June 27 measures, the number of loan applications on the announcement day surged compared to usual."

Financial authorities forecast that from August, the impact of the regulations will begin in earnest, resulting in a more distinct decrease in the housing mortgage loan approval amount.

According to the Korea Real Estate Agency, the change rate in apartment sale prices in Seoul decreased from 0.40% in the fourth week of June to 0.16% in the third week of July. During the same period, the rise in Gangnam slowed from 0.73% to 0.14%, in Mapo from 0.85% to 0.11%, and in Seongdong from 0.89% to 0.37%.

In particular, the regulation limiting the new housing mortgage loan limit to 600 million won in the metropolitan area has been analyzed to be impacting high-priced housing areas within Seoul.

A financial authority official stated, "A significant reduction in loan approvals has been confirmed, especially focusing on the three districts of Gangnam, and fundamentally, transactions are not occurring smoothly."

Banks Also Strengthening Their Own Regulations

Major banks are also initiating their own loan management measures, separate from government regulations. This appears to be a response to the government's decision to reduce the total household loan management target for the second half of the year by 50% compared to the previous year.

Woori Bank expanded the 'LTV 30%' regulation that was previously applied only to regulated areas (Gangnam, Seocho, Songpa, Yongsan) to the entire metropolitan area starting from the 22nd of last month. This aims to suppress loans to housing rental and sales operators.

Nonghyup Bank is also considering similar measures, while SC First Bank has decided to temporarily suspend sales of non-face-to-face housing mortgage loan products until September.

However, there are concerns that the strengthening of these loan regulations may lead to a 'loan cliff' situation, making it difficult for actual borrowers who genuinely need loans to secure funding.

In response, the financial authorities held a household debt inspection meeting on the 25th of last month and urged the financial sector to ensure that the supply of funds to the underprivileged and actual users is not overly tightened.

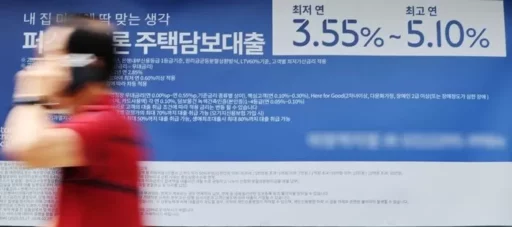

Image source: Data photos for understanding the article / gettyimagesbank, A banner for housing mortgage loan products attached to a bank in Seoul. 2025.6.27 / News1, Photo = Insight, Data photos for understanding the article / News1