**Alert on Selling Foreign Currency Remaining After Overseas Travel: Beware of Money Laundering Linked to Voice Phishing**

Attention is needed as the number of cases where individuals become involved in money laundering linked to criminal funds while attempting to dispose of leftover foreign currency from overseas travel through personal transactions is increasing.

On the 24th, the Financial Supervisory Service issued a consumer alert in response to this situation.

As summer vacation season approaches, posts selling leftover foreign currency on online second-hand trading platforms have increased, and it has been observed that voice phishing criminals are frequently attempting to misuse this for money laundering.

In the case of Mr. A, who resides in Seoul, he posted an advertisement to sell leftover dollars online after returning from a trip abroad. Prior to a face-to-face transaction, a buyer deposited Korean won into Mr. A's wife's bank account, expressing his intent to purchase. However, this money was actually the funds sent directly by a voice phishing victim.

Similarly, Mr. B, living in Gyeonggi Province, encountered a comparable situation after posting his intention to sell euros on a second-hand trading app. The trading partner deposited Korean won into Mr. B's account just 10 minutes before the face-to-face transaction and received the euros through his sibling; however, this too was victim money obtained through voice phishing.

**Cunning Money Laundering Tactics of Criminals**

Money laundering operatives often use strategies to lower sellers’ defenses by offering exchange rates higher than the market rate or promising additional amounts for quick transactions.

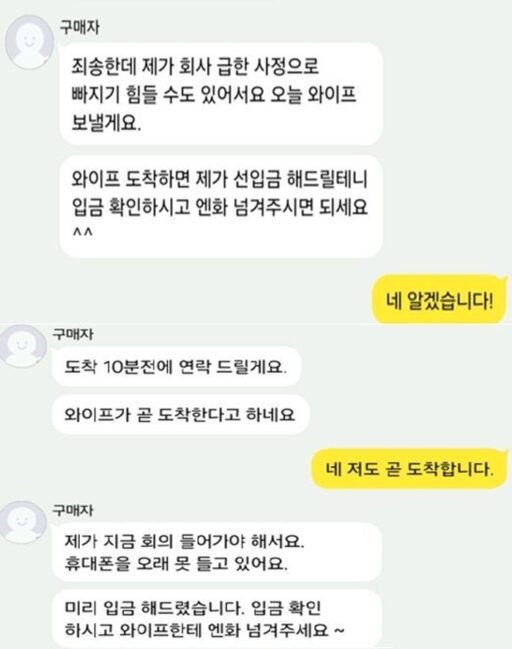

Additionally, to swiftly launder funds before the voice phishing victim becomes aware of the situation, they frequently deposit the transaction amount into the seller's account before meeting to exchange foreign currency.

They also employ tactics where they send a cash collection agent pretending to be a family member or acquaintance, claiming that they are unable to conduct the transaction in person due to urgent circumstances.

By delivering foreign currency to money laundering operatives masquerading as buyers, and receiving in return victim funds directly from the voice phishing victim, individuals can risk becoming involved in the laundering of criminal funds.

In particular, the foreign currency seller's account may be designated as a "fraud-utilized account" under the "Act on the Recovery of Damages from Telecommunications Fraud.” This could lead to serious disadvantages such as account payment suspension, restrictions on electronic financial transactions, forced refund of transaction amounts, and limitations on financial transactions for up to three years.

The Financial Supervisory Service recommends selling foreign currency through authorized foreign exchange banks or officially registered currency exchange operators wherever possible. They also advised not to share bank account numbers in advance to prevent voice phishing and to ensure that transfers are made directly in front of the trading partner after meeting.

Not only foreign currency but also highly liquid assets such as precious metals, second-hand luxury goods, and gift cards can be utilized as similar money laundering means, so caution is necessary.

The Financial Supervisory Service stated that it plans to strengthen consumer guidance in collaboration with platform companies and will continuously monitor suspicious foreign currency transaction posts and fraud-suspected members in real-time to eradicate voice phishing damage related to foreign currency transactions.

Image source: Example of conversation between money laundering operatives and foreign currency sellers / Financial Supervisory Service, material photo for understanding of the article / gettyimagesbank