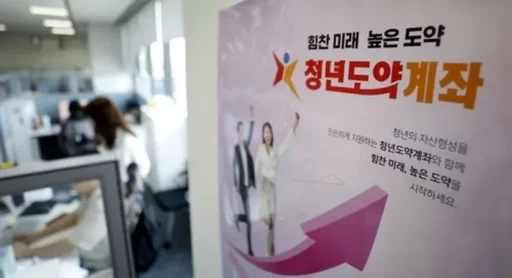

Youth Leap Account, Surge in Early Termination Rate… Discrepancy with Youth Reality Revealed

The 'Youth Leap Account', introduced by the government to support asset formation for the youth, is struggling with a high early termination rate. This situation is analyzed as a direct reflection of the structural income instability and lifelong uncertainty faced by young people.

Despite the government's enticing annual interest rate of 9.5%, the burden of living expenses and unstable income situations are identified as the main reasons making it difficult for youth to maintain their accounts.

Consequently, there are urgent calls for policy improvements and institutional redesign that accurately reflect the real situations of young people.

Five-Year Maturity Product, Gap with Youth Reality

The Youth Leap Account is a policy-based financial product designed for individuals aged 19 to 34, allowing them to form assets up to 50 million KRW by contributing a fixed amount monthly for five years, with tax benefits and interest support from the government.

Though the government has actively promoted this product as a 'solution' for young asset formation, questions about the policy's effectiveness arise as early withdrawals are rapidly increasing.

Rapid Increase in Early Withdrawals

According to materials submitted by the Financial Supervisory Service to Congressman Kang Min-guk's office of the National Assembly's Political Affairs Committee on the 21st, the number of early terminations of the Youth Leap Account as of the end of last month was 358,000, accounting for 15.9% of the total cumulative subscribers of 2.25 million (including one-time deposits).

This marks a significant increase of 7.7 percentage points compared to the early termination rate of 8.2% at the end of last year, highlighting the steep rise in withdrawal rates.

Notably, the termination rate is higher among younger individuals with lower incomes and lower monthly contributions. The termination rate for those contributing less than 100,000 KRW per month is 39.4%, for those between 100,000 and 200,000 KRW it is 20.4%, and for those between 200,000 and 300,000 KRW it is 13.9%, whereas it is only 0.9% for those contributing the maximum of 700,000 KRW. These figures clearly show that income levels are directly linked to the decision to maintain the account.

Long-Term Contribution Structure Misaligned with Youth Lifecycle

Experts analyze that the high early termination rate of the Youth Leap Account is not just an issue of product design but a reflection of the structural income instability and uncertainty about the future experienced by the younger generation.

The five-year long-term contribution structure poses a continuous burden on young individuals who are experiencing critical life transitions such as employment, marriage, and relocation.

To address these limitations, the government is preparing a follow-up product named 'Youth Future Savings'. This product is designed for individuals aged 19 to 34 who have either employment or business income, with proportional government matching support applied for incomes below a certain threshold. It is also considered an upgraded version of the 'Youth Tomorrow Savings' introduced in 2016.

However, concerns are being raised that any financial product will have difficulty being effective unless the structural issues of income instability and uncertainty in the lifecycle of the youth are resolved.

Financial authorities are reportedly also considering a linkage plan that allows existing Youth Leap Account subscribers to convert to the Youth Future Savings.

A source from the financial sector pointed out, "The high early termination rate is not merely a failure in product design but an indication of the instability in the lives of young people," and emphasized that for the follow-up product to be effective, realistic improvements such as differentiated design based on income levels, flexible payment methods, and minimum penalties for early termination are essential.

The outcome of the Youth Leap Account's implementation raises fundamental questions about the overall design direction of youth policy beyond the success or failure of a simple financial product.

Without policy designs that accurately reflect the real situation of young people, no incentive will be sustainable, highlighting the need for a more sophisticated approach and long-term solutions from the government.

Image Source: News1, stock photos for understanding the article / gettyimagesbank, stock photos for understanding the article / gettyimagesbank