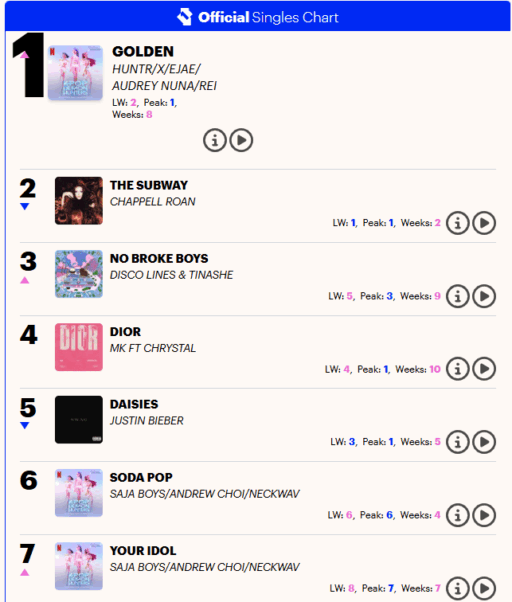

Obesity Drug Market Competition Intensifies

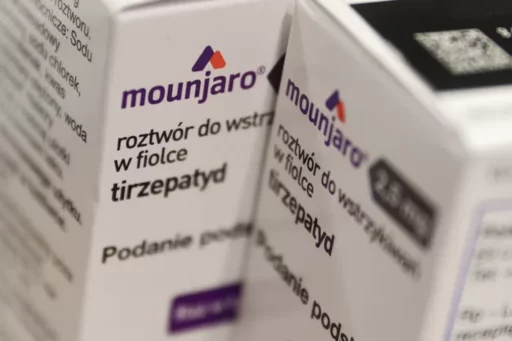

Eli Lilly's obesity treatment 'Monjaro' (ingredient name: Tirzepatide) will begin to be prescribed in domestic healthcare institutions starting next week.

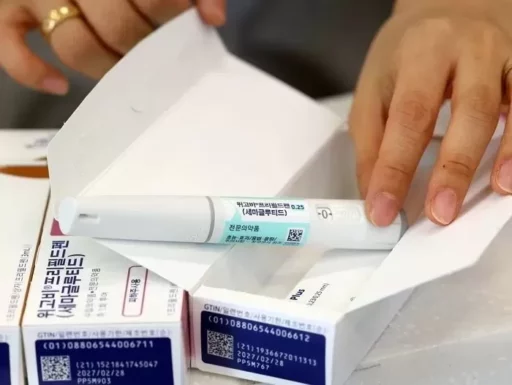

As Novo Nordisk's 'Wegovy' (ingredient name: Semaglutide) has been dominating the domestic obesity drug market, a competitive landscape between the two products is expected to take shape.

According to industry sources, wholesalers that have signed supply contracts with Lilly plan to start distributing Monjaro from the 20th of this month. Accordingly, it is expected that prescriptions for Monjaro could be possible in healthcare institutions as early as the 21st.

However, for tertiary hospitals, approval procedures from each institution's pharmacy committee are required, which may prolong the time until actual prescriptions are made.

The supply price of Monjaro for the initial dose of 2.5 mg (4-week supply) is set at 280,000 KRW, while the maintenance dose of 5 mg is priced at around 370,000 KRW.

Higher-dose products, such as the 7 mg which is to be introduced in phases, are anticipated to exceed 500,000 KRW.

Lilly is adopting a strategy of first supplying lower-dose products to secure initial market share.

Weight Loss Effects and Market Competitiveness

The biggest strength of Monjaro is its superior weight loss effect compared to Wegovy.

Monjaro acts as a dual-action drug by stimulating both the GLP-1 (glucagon-like peptide-1) receptor and the GIP (gastric inhibitory peptide) receptor, showing better weight loss results than Wegovy, which is a single-action GLP-1 agent.

According to Lilly, Monjaro demonstrated an average weight reduction rate of 20.2% over 72 weeks in a clinical trial involving 751 overweight patients. Other studies reported a maximum weight reduction rate of 22.5%.

In contrast, Wegovy showed a weight reduction rate of 14.9% over 68 weeks.

Based on these effects, Monjaro's market share is rapidly expanding in the United States. Currently, Monjaro’s share in the U.S. GLP-1 obesity treatment market is approaching 60%.

However, Wegovy is not standing still. Novo Nordisk has responded strategically by choosing to lower prices ahead of Monjaro's launch.

Wegovy was initially priced at 372,000 KRW for all doses, but has recently implemented a differential pricing system. The starting dose (0.25 mg) is now offered at a discounted price, reduced to 200,000 to 220,000 KRW.

Side Effects and Market Outlook

Both products have reported side effects, so caution is necessary when using them. Gastrointestinal symptoms such as nausea, vomiting, diarrhea, and constipation are common side effects.

In rare cases, chronic use may result in risks such as intestinal obstruction, gallbladder disease, and pancreatitis.

Experts suggest that suitability for patients may vary based on the mechanisms of action of the two medications, making it difficult to definitively conclude which product will dominate the market based solely on weight loss effects.

Image source: Eli Lilly Obesity Treatment Monjaro / gettyimageskorea, Reference photo to aid understanding of the article / gettyimagesbank, Wegovy / News1