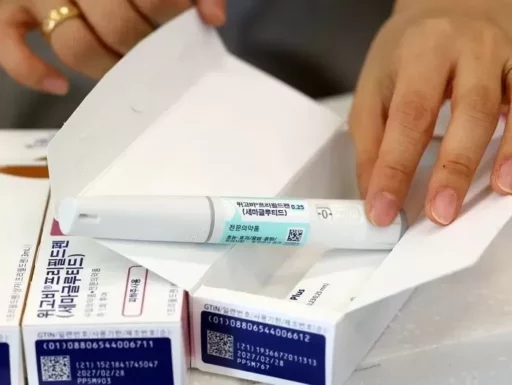

The new obesity treatment 'Mounjaro' with strong efficacy and low price is set to launch soon.

Eli Lilly's obesity treatment 'Mounjaro (active ingredient terzepatide)' is poised for a full-fledged entry into the domestic market.

Mounjaro is expected to change the landscape of the obesity treatment market, leveraging a price that is 25% lower and stronger efficacy compared to Novo Nordisk's 'Wegovy (active ingredient semaglutide)', which has dominated the existing market.

According to the pharmaceutical industry on the 8th, Mounjaro will officially launch in the country during the third week of this month (18-22).

Novo Nordisk's monopoly in the domestic obesity treatment market, previously held through products like 'Saxenda' and 'Wegovy', is now showing signs of fragmentation.

The market entry strategy for Mounjaro is clear. It aims to capture consumers with stronger efficacy and lower prices.

Stronger efficacy and lower prices

According to the industry, the release price of Mounjaro 2.5 mg has been set at 278,000 won. This is the price for a box containing four pens that are administered once a week, which is about 25% lower than Wegovy's release price of 372,000 won.

The market had expected Mounjaro to be 10-20% cheaper than Wegovy, but the actual pricing policy has been even more aggressive.

The onset of serious price competition in the obesity treatment market

Mounjaro's pricing strategy is differentiated by treatment stages. The 2.5 mg dose serves as the 'starting dose' for the initial treatment phase, with patients increasing their dose at four-week intervals.

The supply price for the maintenance dose of 5 mg has been set at 369,000 won, which is similar to Wegovy's price but remains relatively inexpensive. Future release prices for the 7.5 mg and 10 mg are expected to be higher, around 520,000 won.

Like Wegovy, Mounjaro is a non-reimbursable item not covered by health insurance. Therefore, the final selling price is likely to vary by medical institution.

Currently, the price of Wegovy differs significantly between hospitals, ranging from 400,000 won to 700,000 won.

Mounjaro boasts superior weight loss efficacy compared to Wegovy. Results presented at the European Congress on Obesity (ECO) showed an average weight reduction rate of 20.2% after 72 weeks in a comparative clinical trial involving 751 adult obesity patients.

This figure is 47% higher than the 13.7% seen in the Wegovy group, demonstrating Mounjaro's excellent efficacy.

Mounjaro's entry into the domestic market is expected to serve as a catalyst for intensified price competition in the obesity treatment market.

Recently, the global pharmaceutical company Sandoz announced it would reduce prices for GLP-1 obesity medications, including Wegovy and Mounjaro, by up to 70% starting in January next year.

This indicates a trend of price reductions for obesity treatments in the global market.

The launch of generic drugs, which are copies of original medicines (newly developed drugs), is also on the horizon. Indian pharmaceutical companies are accelerating generic development in line with the expiration of Wegovy's patent in India later this year.

There are projections that once generics are fully launched in the global market after March 2026, the prices of obesity treatments could drop by up to 80%.

Image sources: Eli Lilly's obesity treatment Mounjaro / gettyimageskorea, Mounjaro / Korean Lilly, Wegovy / News1, illustrative photos for understanding the article / gettyimagesbank