The government is pushing to introduce shared-equity mortgages… Expectations to alleviate housing purchase burden

Financial authorities are preparing to implement 'shared-equity mortgages' where the government and consumers jointly purchase and sell homes, sharing profits upon sale.

Reactions in the market are mixed.

According to financial authorities on the 28th, the Financial Services Commission is preparing a 'shared-equity mortgage' that allows the Korea Housing Finance Corporation (KHFC), a policy financing institution, to participate as an equity investor when individuals purchase homes, thereby alleviating the buyers' loan burden.

Specific details are planned to be included in a roadmap to be announced in June.

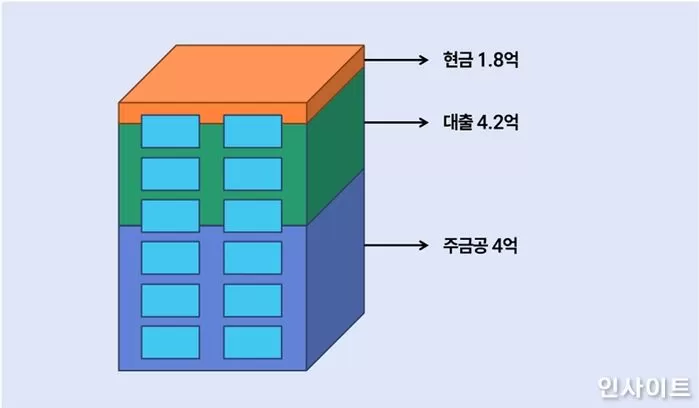

The working mechanism of shared-equity mortgages is as follows. For example, when purchasing a house worth 1 billion won, if KHFC invests in up to 40% of the house price, the buyer will only be subject to the loan-to-value ratio (LTV) on the remaining amount.

If KHFC invests 400 million won, the buyer will apply LTV of 70% to the remaining 600 million won, receiving a loan of up to 420 million won from the bank.

In this case, the individual only needs 180 million won in cash to purchase a house worth 1 billion won. If there is excess funding later, it is also possible to acquire additional equity.

Advantages and disadvantages of shared-equity mortgages and market responses

The buyer must pay a fee for KHFC's investment in addition to the monthly interest on the loan. Financial authorities plan to apply an interest rate in the low 2% range, lower than that for jeonse loans, to reduce the monthly burden.

When selling the house, the capital gains will be shared according to the equity ratio between the buyer and KHFC, and in cases where the house price falls, KHFC, as the subordinate investor, will bear losses first.

The background for promoting this system is to alleviate the sharply rising household debt. It is beneficial for those who find it difficult to bear the high house prices alone, as it can reduce their debt burden.

Alleviating rising household debt

There are also positive evaluations regarding contribution to housing stability.

The initial capital required for purchasing a home is significantly reduced, providing more opportunities for young people and newlyweds with insufficient cash availability to obtain a home.

People with insufficient initial capital will also have the chance to secure housing and benefit from some of the price increases.

Concerns and challenges regarding shared-equity mortgages

However, there are also many concerned perspectives. Financial authorities are reportedly planning to set support limits by region, applying shared-equity mortgages only to homes worth 1 billion won or less in Seoul, 600 million won or less in Gyeonggi Province, and 400 million won or less in provincial areas.

There are worries that demand will be concentrated in specific price ranges eligible for the program, potentially driving up home prices due to increased demand. The financial burden on public institutions is also concerning, as KHFC would bear the investment losses in case of a decline in housing prices.

The obligation to share profits with KHFC when home prices rise, or the psychological resistance stemming from not owning a home completely, could also become obstacles.

To succeed in this business, there are calls for tax benefits and additional incentives. Also, a shift in perception that it is acceptable not to fully own a home is being requested.

Image Sources: Material photos to aid understanding of the article / News1, material photos to aid understanding of the article / gettyimagesbank